If you are an online shopper or seller, you may have heard of the new sales tax on low value goods (LVG) that will take effect in Malaysia from 1 January 2024. But what exactly are LVG and why are they subject to sales tax in Malaysia?

LVG are goods that are sold at a price not exceeding RM500 and are brought into Malaysia by land, sea, or air. These goods do not include cigarettes, tobacco products, intoxicating liquors, and smoking pipes — all of which are already subjected to an import duty, excise duty, and sales tax. The rate of sales tax for LVG is 10%, regardless of the Harmonized System (HS) code of the product.

The sales tax on LVG is part of the government’s efforts to level the playing field between local and foreign sellers, as well as to enhance tax compliance and revenue collection. Previously, LVG were exempted from sales tax under the Sales Tax Act 2018, which gave foreign sellers an unfair advantage over local sellers who had to charge sales tax on their goods.

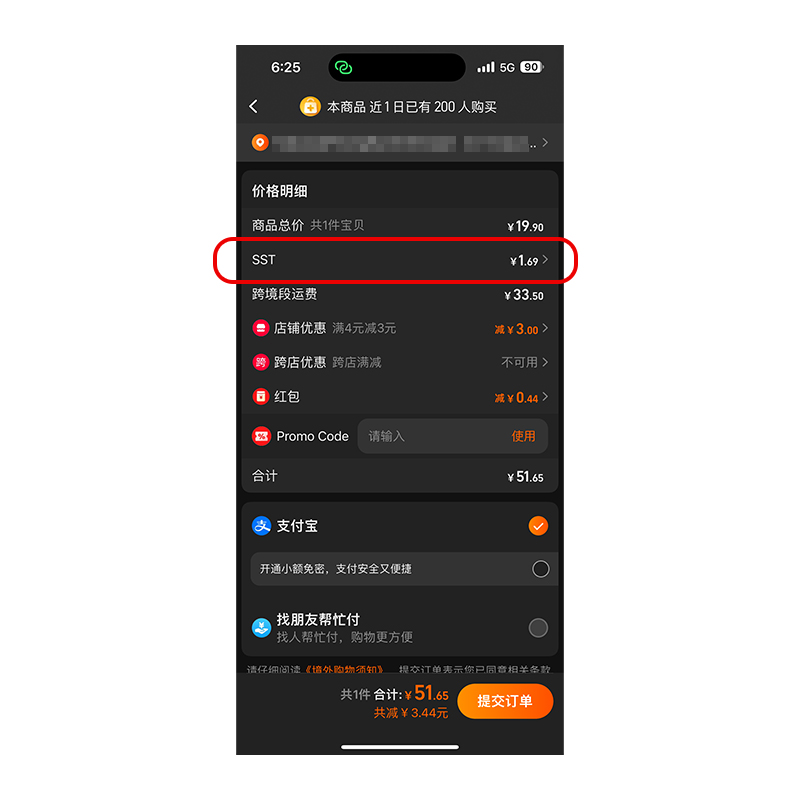

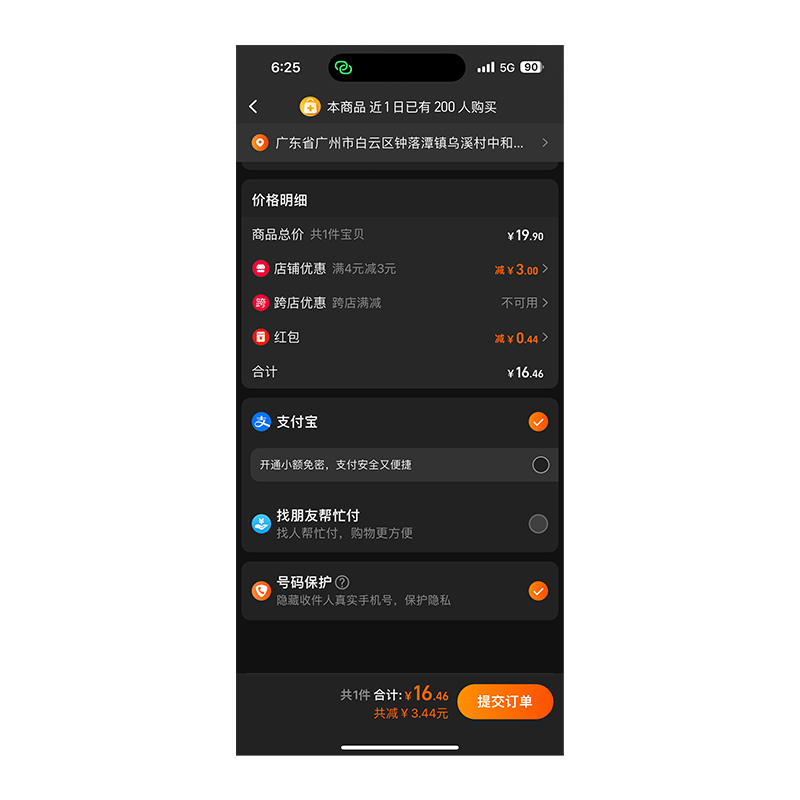

However, there is a loophole that savvy consumers can use to bypass the sales tax when purchasing from China-based platforms like Taobao or Pinduoduo. By changing the recipient address to a Chinese address, shoppers can avoid triggering the platform to collect sales tax. Utilizing a freight forwarding service can facilitate this process seamlessly, allowing consumers to enjoy their purchases without the additional tax burden.

When the recipient address is set to a Malaysian address, the platform will automatically collect sales tax. On the contrary, when the recipient address is set to a Chinese address, the platform does not collect sales tax.While this method may provide a temporary solution for avoiding sales tax, it's important to note that tax laws and regulations are subject to change, and the Malaysian government may implement measures to address such loopholes in the future. As always, consumers should stay informed and comply with relevant tax laws in their respective jurisdictions.

Ready to shop smarter and save on sales tax? Contact us today to learn more about how our freight forwarding services can help you avoid unnecessary taxes and enjoy hassle-free shopping experiences!